In Q1 2016, the ex-works price of high fructose corn syrup (HFCS) stayed

sluggish in China. For instance, the average ex-works price of F55 HFCS was

USD401/t (RMB2,625/t) on 16 March, down by 4% over USD416/t (RMB2,710/t) in

Jan. This can be mainly attributed to:

- Decreased price of corn. According to CCM's price monitoring, the market

price of corn was USD286/t (RMB1,870/t) on 16 March, down by 6% over Jan. This

pulled down the production costs for HFCS and price also. Threat from low-price corn from North China: the purchase of corn for

temporary storage has been accelerated in Northeast China. By 15 March, the

storage of corn harvested in 2014/15 (2014/15: Oct. 2014-Sept. 2015, similarly

hereinafter) reached 97.16 million tonnes in the region, recording a historical

high.

This resulted in the decreased circulation of corn from Northeast China

in the market. As North China was not involved in the temporary storage

programme, its supply of corn was sufficient and low-priced. According to CCM's

research, the market price of corn from North China was about USD260/t

(RMB1,700/t) on 16 March, vs. USD291/t (RMB1,900/t) for corn from Northeast

China. The overall spot market was full of corn from North China

Notably, as the domestic spring ploughing of corn is coming, farmers are eager

to selling off the corn, thus strongly inclining to lowering prices for sales

promotion.

- Limited downstream demand. Before the Spring Festival, downstream enterprises

had already stocked up HFCS sufficiently. After the Spring Festival, as the

consumption was sluggish – demand for candy and beverages was restricted,

downstream enterprises were running down their stocks mainly.

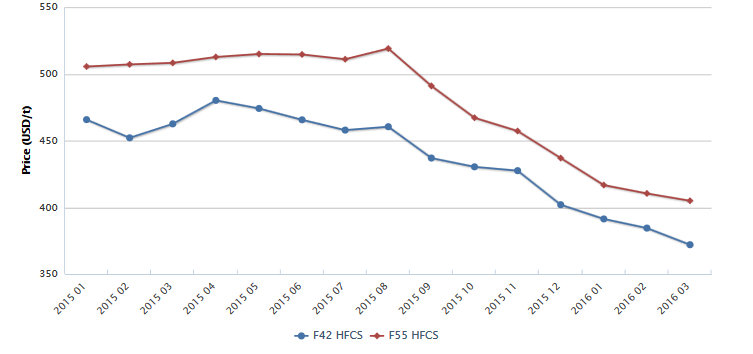

Monthly ex-works prices of F42 HFCS and F55 HFCS in China, Jan. 2015-March 2016

Source: CCM

It is expected that the HFCS price will continue falling throughout 2016, mainly

because the price of corn will go down further.

- The target sales policy for temporarily-stored corn is to be issued. Targeted

at specific enterprises, the corn stored for a relatively long term and having

quality problem will be sold, given subsidy. It is supposed that the corn to be

sold this time is that harvested in 2011/12 and 2012/13 planting seasons,

probably targeted at alcohol producers (incl. ethanol producers) and subsidy

given after use at USD31/t (RMB200/t). In order to sell such corn successfully,

the pricing will be far below the market price, at about USD229/t (RMB1,500/t).

This will pull down the market price of spot corn.

- The * auction policy for temporarily-stored corn is to come out. In view of

the high storage (= 250 million tonnes) and in consideration of the failure in

2015 due to high auction price, the Chinese government, of great possibility,

will down-regulate this price.

* Auction policy: to be introduced after the purchase of corn (in 2014/15) for

temporary storage comes to a close on 30 April, 2016.

It is worth noting that as the HFCS price is going down constantly, the price

gap between HFCS and white sugar will be enlarged gradually, expected to push

up the HFCS consumption. On 16 March, the market price of white sugar was

around USD826/t (RMB5,400/t), up slightly over USD821/t (RMB5,340/t) in

Jan. Given that the price of white sugar will continue upturn, HFCS will be

advantaged further regarding price.

This article comes from Sweeteners China News 1603, CCM

About CCM:

CCM is the leading market intelligence provider for China’s

agriculture, chemicals, food & ingredients and life science markets.

Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports.

Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: HFCS corn